Are you sick of your bank or just want to switch? Barclays is a bank account that you will most likely come across when looking for a new one. It is a well-known high street bank and one of the largest in the UK.

But how straightforward is it to open a UK Barclays bank account? Below, we’ll walk you through the full process, including what documents you’ll need and how long it will take. It should be simple to open a new account with our help.

However, keep in mind that there are alternative methods for handling your finances besides a bank account. The best option is the Wise account from money services provider Wise, especially for overseas card payments and transfers.

Prerequisites for opening a Barclays bank account?

Although the requirements for new users may vary depending on the type of account, most UK banks have similar or comparable requirements.

In order to register for a Barclays current account, you must be:

- Older than eighteen

- A citizen of the United Kingdom.

To become a customer of Barclays Private Banking, you must earn a minimum of £75,000 in gross yearly income. Additionally, if you have investments or savings with the bank worth at least £100,000, you will be qualified.

You must be a resident of the UK and at least 16 years old to apply for the majority of Barclays savings accounts.

Different conditions, such as being a UK tax resident, are probably in place for cash ISAs. So be sure you’re eligible before comparing AER interest rates on savings accounts. It only takes a few seconds.

Of course, there are additional conditions to fulfil if you’re opening a business account in the UK.

What paperwork is required to create a bank account with Barclays?

In order to apply for a Barclays current account, you must submit the following paperwork:·

Proof of identity – such as your passport, UK/EU driving licence, UK biometric residency permit (BRP) or HMRC letter from the last 12 months.

A recent utility bill, bank statement, Universal Credit statement, or credit card statement from the previous three months can all serve as proof of address. If you don’t have any of these documents and need to know how to get proof of address, here’s a guidance on how to do it in the UK.

Your address, phone number, and other personal information, including your nationality and date of birth, must be provided. Barclays might also inquire about your work and income.

When registering for a Barclays student bank account, you’ll probably be required to present a legitimate student ID.

How can I start a bank account with Barclays?

It’s time to apply for your new bank account after you’ve acquired your identification and other necessary paperwork.

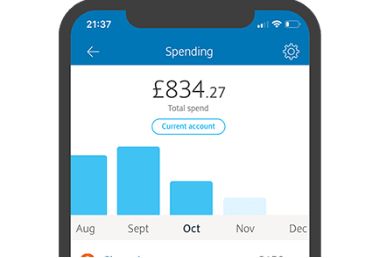

You can use the Barclays mobile app or go online to complete the process.

To begin, just take these actions:

- Choose a current account on the Barclays website.

- Carefully review the eligibility conditions and pertinent legal information for the current account you have selected.

- You can proceed to the bottom of the page by clicking the “How do I apply” option.

- Click the “online form” option to apply online. As directed by the on-screen instructions, enter your information and attach identification documents as needed.

- Click “Apply in the app” to submit an application through the mobile app. You can download it from the App Store or Google Play Store, depending on your device.

Is it possible to open a Barclays online bank account?

Yes, you can apply for a Barclays account online, which is what the bank encourages.

Whether you utilise the mobile app or complete the process on your laptop or desktop computer, it should be pretty quick and simple.

How long does it take to open a Barclays bank account?

If you apply for a new account through the mobile app, Barclays says it should take about 10-15 minutes.

If accepted, your account will be accessible for use immediately. You will receive your debit card and PIN within 5 business days.

The bank does not specify how long it takes to apply online, but you should assume a similar duration.

If you use the Current Account Switch Service to transfer an account from another bank to Barclays, the process should take no more than 7 working days.

How can I contact Barclays customer service?

If you have any questions about Barclays products or need assistance opening an account, please contact the bank’s customer support staff.

Here is the contact information you need:

- Phone – call 0345 600 4545, line accessible Monday through Saturday, 8am to 6pm.

- Find the nearest Barclays branch here.

- Send a message online by logging into your online banking (existing customers) or using Apple Messages.

Wise: An alternative to a Barclays bank account.

While you’re comparing accounts and providers, look into the Wise account. It is not a bank account, but it is an excellent alternative to a Barclays bank account because it provides many of the same benefits.

When you sign up with Wise online, there are no startup or monthly fees.

You’ll receive a robust account for managing your money in over 40 currencies, including the ability to make international payments with low fees and mid-market exchange rates.

For a one-time price of £7, you can obtain a Wise debit card with no foreign transaction fees for spending abroad and only a tiny conversion fee for cross-border purchases.

You can withdraw up to £200 per month in up to two transactions from abroad ATMs with no Wise costs.

After reading this, you should know exactly how to open a Barclays bank account.

It’s simple to do online or using the mobile app, as long as you have the necessary paperwork. It works similarly to opening any other UK bank account. And if you need assistance, you can always call Barclays Customer Service.

FAQs

Can I open or upgrade to a Premier Current Bank Account?

To apply for Premier Banking, you must have a current account with us and either

Earn a gross annual income of at least £75,000. To open a current account, your net equivalent income (after taxes and deductions) must be at least £3,330 per month or £40,000 over the previous 12 months.

Have a total amount of at least £100,000 in savings with us, Barclays UK investments, or a combination of both.

How can I receive money from abroad?

To receive an international payment, you must first provide the sender with certain information, such as

You can get your International Bank Account Number (IBAN) on your bank statement or by selecting the applicable bank account from your app’s home page and hitting ‘Manage’.

Your sort code, account number, and Barclays SWIFT code BUKBGB22 (unless you’ve provided your IBAN)

Your entire name.

Your address.

The amount and currency you want to receive the payment in.

You will also need to agree with the sender on who will pay the charges.

Receiving a SEPA credit transfer.

SEPA Credit Transfers are a sort of international payment in euros made from nations throughout Europe. To receive a SEPA payment, simply supply the sender with your IBAN and the full account name.

Receiving payments in US dollars.

You might be asked to submit information on who Barclays UK has accounts with in the United States, including their ABA code. This is equivalent to a UK sort code and is often referred to as the FedWire number. Barclays Bank UK’s PLC USD account is housed at Barclays Bank PLC in New York, and the ABA number is 026002574.

How can I file a complaint?

We are sorry that something went wrong and you wish to complain. We always want to know what happened so that we can continue to improve.

If you contact us through your app, you will already be logged in, allowing us to view your account information. Simply contact us through the app’s ‘Message us’ button.

It’s safe, and we can message you back between 7 a.m. and 11 p.m. on any day. Outside of such times, our digital assistant is available 24 hours a day, seven days a week.

Leave a Reply